In 1991, we assessed the performance of 49 joint ventures and alliances and found that only 51% were “successful”-that is, each partner had achieved returns greater than the cost of capital.

Benefit of joint venture how to#

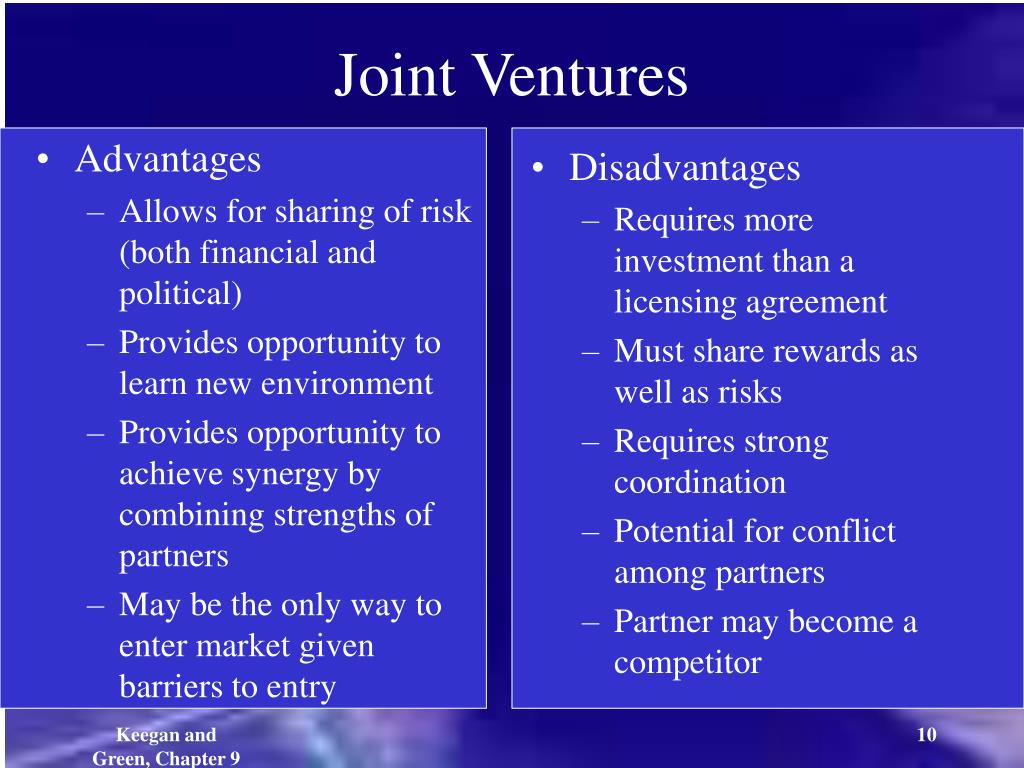

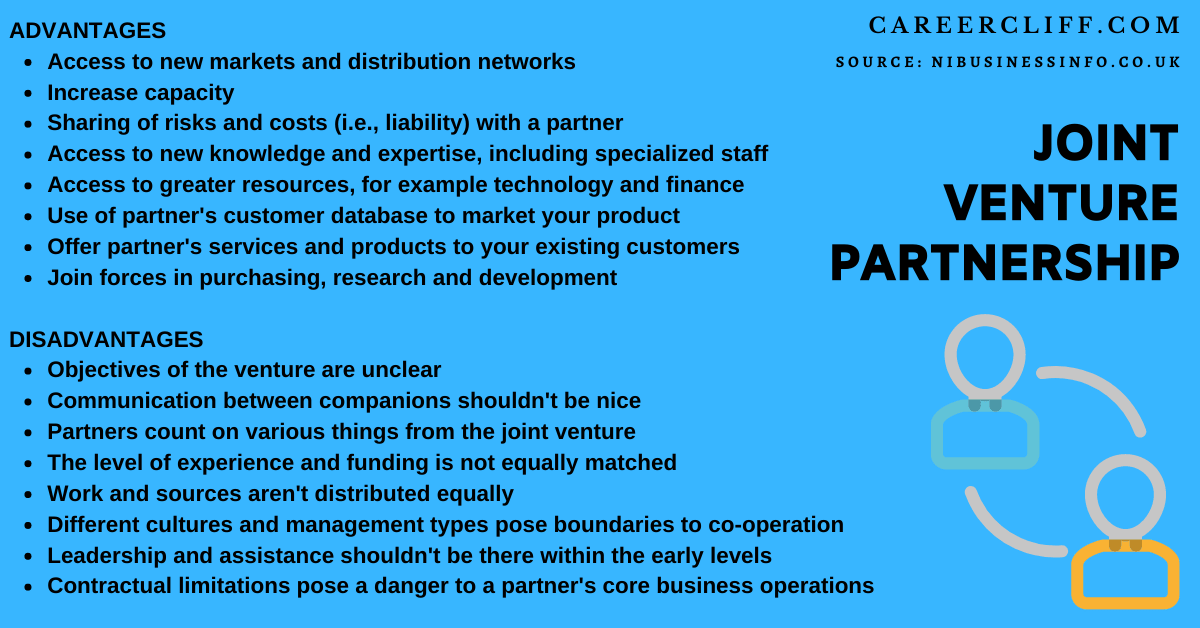

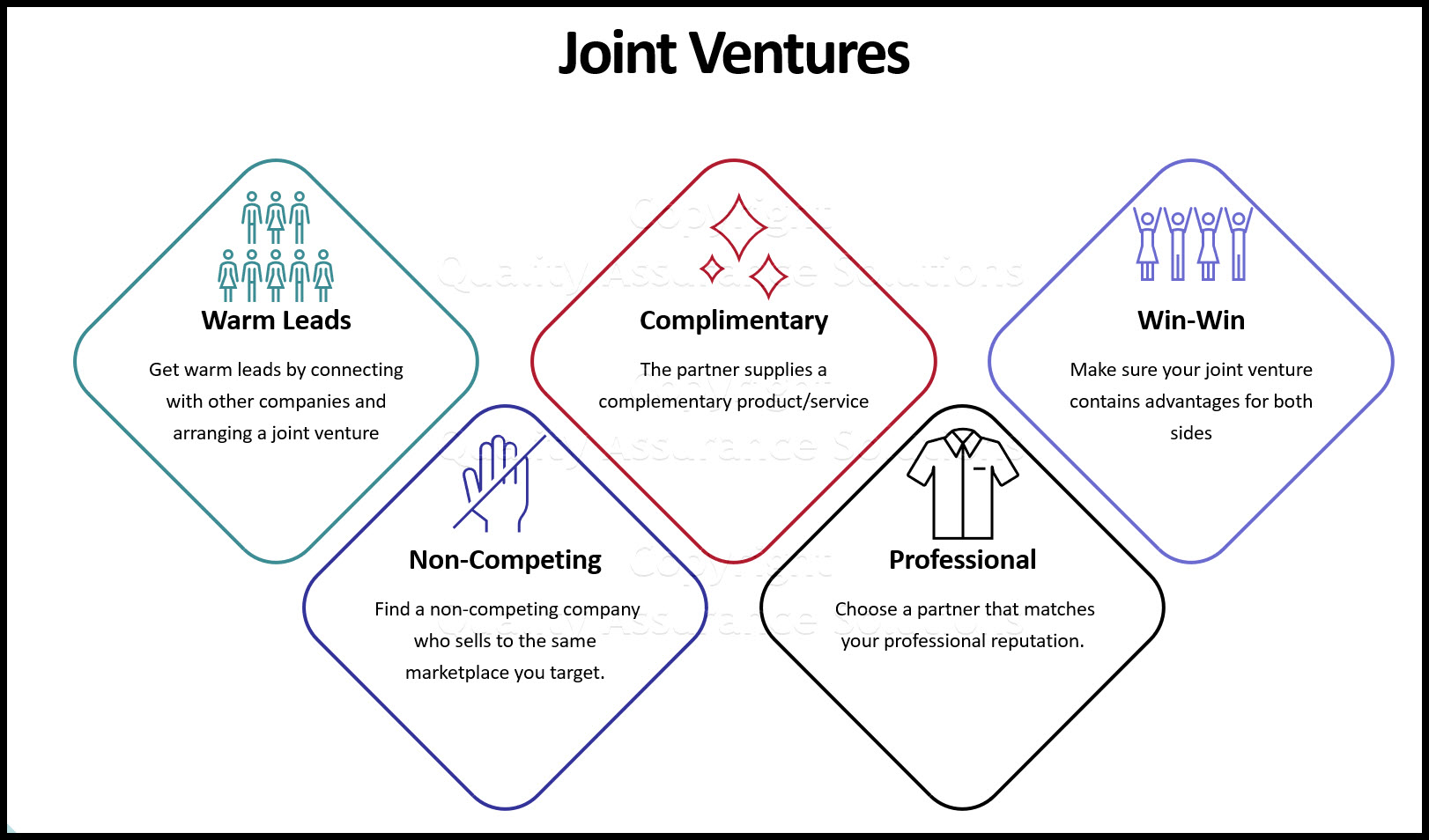

What’s less clear to these companies is how to overcome the many challenges inherent in implementing joint ventures and alliances. So it’s become clear to many companies that alliances-both equity JVs (where the partners contribute resources to create a new company) and contractual alliances (where the partners collaborate without creating a new company)-can be ideal for managing risk in uncertain markets, sharing the cost of large-scale capital investments, and injecting newfound entrepreneurial spirit into maturing businesses. The largest 100 JVs currently represent more than $350 billion in combined annual revenues. More than 5,000 joint ventures, and many more contractual alliances, have been launched worldwide in the past five years. Using real-world examples, the authors offer their suggestions for meeting these challenges. And fourth, build a cohesive, high-performing organization (the JV or alliance)-not a simple task, since most managers come from, will want to return to, and may even hold simultaneous positions in the parent companies. Third, manage the economic interdependencies between the corporate parents and the JV. Second, create a shared governance system for the two parent companies. First, build and maintain strategic alignment across the separate corporate entities, each of which has its own goals, market pressures, and shareholders. Specifically, the launch team must tackle four basic challenges.

During this period, it’s critical for the parents to convene a team dedicated to exposing inherent tensions early. The launch phase begins with the parent companies’ signing of a memorandum of understanding and continues through the first 100 days of the JV or alliance’s operation. As a result, the parent companies experience strategic conflicts, governance gridlock, and missed operational synergies. Most companies are highly disciplined about integrating the companies they target through M&A, but they rarely commit sufficient resources to launching similarly sized joint ventures or alliances. The authors, all McKinsey consultants, argue that JV success remains elusive for most companies because they don’t pay enough attention to launch planning and execution. The problem is, the success rate for JVs and alliances is on a par with that for mergers and acquisitions-which is to say not very good. Companies are realizing that JVs and alliances can be lucrative vehicles for developing new products, moving into new markets, and increasing revenues. For example, the foreign entity may bring new technologies or business practices into the joint venture, while the domestic entity already has commercial relationships and requisite governmental documents within the country, along with being entrenched in the domestic industry.More than 5,000 joint ventures, and many more contractual alliances, have been launched worldwide in the past five years. Foreign entities form joint ventures with domestic entities already present in markets the foreign entities would like to enter. Joint ventures are widely used to gain entrance into foreign markets. A mechanism or provision for the sharing of profits or losses.Ī joint venture is not a partnership or a corporation, although some legal aspects of a joint venture (such as income tax treatment) may be ruled by partnership laws.Some degree of joint control over the single enterprise or project.Mutual contributions by the parties to the joint venture.An agreement (written or oral) between the parties manifesting their intent to associate as joint venturers.Although there is no statutory definition of a joint venture, courts in several states such as New York have recognized the following are the elements of this type of association: The creation of a joint venture is a matter of facts specific to each case. The parties may contribute capital, labor, assets, skill, experience, knowledge, or other resources useful for the single enterprise or project. The parties to the joint venture must be at least a combination of two natural persons or entities.

A joint venture is a combination of two or more parties that seek the development of a single enterprise or project for profit, sharing the risks associated with its development.

0 kommentar(er)

0 kommentar(er)